If you are a foreign owner of a company incorporated in the United States, it is important to be fully aware of your tax obligations to the IRS. Even if your company does not generate profits or conduct any business in the United States, there are still requirements that must be met annually to avoid fines and legal consequences. One of the most important of these requirements is completing and submitting Forms 1120 and 5472.

In this article, we'll take you through a detailed understanding of how to file a tax return for foreign nationals. We'll explain the importance of these forms, the steps required, common mistakes, and when to file them. We'll also provide important tips to help you comply with the law and avoid any future problems.

What is IRS Form 1120 for Filing Corporate Tax Returns in the U.S.?

The model 1120 It is the primary tax return for U.S. corporations, used to report income, expenses, gains and losses, and taxes owed. Foreign companies that own a U.S. corporation (even if they do not have income) must file this form annually.

What’s Included in IRS Form 1120 for U.S. Corporate Tax Filing?

- Any company incorporated in the United States (including non-profitable companies).

- Companies with foreign ownership of 25% or more.

- Single-member limited liability companies (SMLLCs) are wholly owned by foreign persons, even if they have no income.

Form 1120 Contents

- Basic information About the company.

- Income details Such as revenue, cost of goods, other income.

- Expenses and costs Such as salaries, rent, advertising.

- Final Account For net profit or loss.

- Taxes due And advance payments.

You can download the form directly from the official website via the following link:

https://www.irs.gov/forms-pubs/about-form-1120

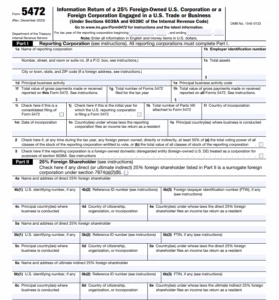

IRS Form 5472 Explained: U.S. Tax Filing for Foreign-Owned Corporations

The model 5472 It is an information statement that must be submitted to the IRS by U.S. corporations with 25% or more foreign ownership, or single-person entities owned by foreigners, when there are financial transactions between the foreign entity and the U.S. entity.

Who Must File IRS Form 5472 for Foreign-Owned U.S. Companies?

- US companies that are 25% or more foreign-owned.

- Foreign companies doing business in America.

- Single-member limited liability companies (SMLLCs) wholly owned by foreigners.

What Information is Required on IRS Form 5472 for U.S. Tax Compliance?

- US company information.

- Details of the foreign owner (name, address, country, percentage of ownership).

- Details of any financial transactions (such as deposits, loans, purchases, services, etc.).

- Signature of the company official.

You can download the form directly from the official website via the following link:

https://www.irs.gov/forms-pubs/about-form-1120

IRS Filing Deadline for Forms 1120 and 5472: U.S. Corporate Tax Returns

- Form 1120 and 5472 They must be submitted together by April 15 of each year if the company uses the Gregorian calendar.

- Can be submitted Form 7004 To request an extension until October 15.

IRS Penalties for Late or Missing Form 5472 and 1120 Tax Filings

- A fine of up to 25,000 US dollars For each Form 5472 that is late in filing.

- Additional penalties of up to $25,000 additional For each month of delay after receiving notice from the Tax Authority.

- Penalties may apply to Form 1120 if you fail to file.

Do You Need to File a Tax Return If Your U.S. Company Has No Income?

A common misconception is that some business owners believe they don't need to file returns unless they generate income or operate without any activity. However, this is completely false. If your company is registered in the US and owned by a foreigner, you are required to file both forms, regardless of activity or income.

How to File IRS Forms 5472 and 1120 Correctly for U.S. Tax Compliance

- Obtaining an EIN (Employer Identification Number) from the IRS.

- Preparing financial records:Even if it is simple or there are no transactions.

- Determine transactions with foreign parties.

- Complete Form 1120 completely..

- Fill out Form 5472 and link it to Form 1120..

- Submit forms electronically or by mail.

- Maintain backups and supporting records.

FAQs About U.S. Tax Filing for Foreign-Owned Companies (Forms 5472 & 1120)

Do I have to be a US resident to submit these forms?

No, these forms can be submitted from outside the US, but you must have an EIN and a tax representative or advisor who understands the US tax system.

Can I submit the forms myself?

Theoretically yes, but in practice it is highly recommended that you seek the help of a tax advisor with experience with foreign companies due to the fine details of the forms.

What happens if I don't submit the forms?

You face significant fines and the possibility of your business being shut down or suspended by the IRS, which could affect your bank account and business licenses.

Best Tax Filing Services for IRS Forms 5472 & 1120 – Accurate & Penalty-Free

We are in Ghayat Company We have extensive experience providing tax services to foreign individuals. We guarantee:

- Submitting forms accurately.

- Adherence to deadlines.

- Reduce the chances of fines.

- Annual follow-up of your condition.

We don't just fill out forms, we help you with:

- Obtain an EIN number.

- Analyze your tax situation.

- Providing future guidance for your company's safe growth.

Book your consultation now

Direct WhatsApp: 05372851589

Website: ghayatltd.com

Let us take care of your tax return, while you focus on growing your company.

This article is for educational purposes only and is not legal or tax advice. It is always best to consult a licensed tax advisor based on your individual circumstances.

Contact us now