Unlock the U.S. Financial System: Get Your ITIN from Abroad in 2025 — Fast, Legal & Hassle-Free

Are you located outside the United States and need a US tax identification number (ITIN)? Whether you're an online freelancer, own a US business, or need to open a US Stripe or PayPal account, an ITIN is key.

In this comprehensive article, we'll discuss in detail the importance of an ITIN, why it's necessary for people outside the US, and the steps required to obtain one, especially if you're in Turkey or any other country. Most importantly, we'll discuss how we can help you obtain an ITIN easily and 100% legally.

What is an ITIN?

ITIN is an abbreviation for Individual Taxpayer Identification NumberA number issued by the Internal Revenue Service (IRS) to people who are not eligible for a Social Security Number (SSN), but need it for tax purposes within the United States.

This number is made up of 9 digits and is used for several things:

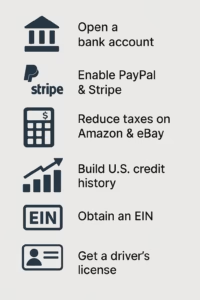

- Filing taxes with the IRS

- Open financial accounts in America, such as Stripe or Payoneer

- Buying real estate in America

- Dealing with American banks

- Investing in America

- Establishing and Taxing a US Company

Who needs an ITIN?

- Entrepreneurs who have founded US companies and want to interact with the tax system

- Freelancers who work online and receive income from America

- People who want to use services like Stripe, PayPal, Amazon, etc.

- Owners of YouTube channels or content platforms, to collect profits officially

- Foreigners who buy real estate or invest in America

- Anyone who needs to file taxes or transact financially with the US system

Why is the ITIN number so important?

- Opens the doors to Stripe and PayPal for youWithout an ITIN, many financial services require US tax proof to open an account.

- Necessary when establishing a US companyIf you start a US business, you will likely need an ITIN for tax purposes.

- Enhances your credibility with US agenciesWhen you submit an ITIN, you demonstrate your seriousness and commitment.

- Helps you avoid excess taxesThrough international tax agreements, you can save significant amounts of money.

- Gives you the power to transact financially globallyHaving an ITIN makes your financial position more professional.

Steps to obtain an ITIN in 2025

Step 1: Complete Form W-7

This is the official ITIN application form. It requires accurate information.

Step 2: Determine the reason for requesting an ITIN.

You need to explain the reason precisely: starting a company, opening a Stripe account, filing taxes, etc.

Step 3: Prepare personal documents

They usually ask for the original passport or a certified copy.

Step 4: Submit the application to the IRS

The application is sent by mail or through an authorized agent.

Ok... why don't I do it myself?

Many people tried to advance on their own and lost time and money:

- They provided incomplete information and the application was rejected.

- They sent the wrong papers.

- Waited months with no response

We save you all the trouble:

- We have prepared all the papers for you.

- We submit the application to you officially and legally.

- Follow up the order step by step

- We provide you with proof of submission + tracking number.

Why choose us for ITIN service?

✅ Deep experience and knowledge of US laws

✅ Direct contact with IRS-authorized agents

✅ Quick and clear procedures

✅ Full Arabic support from start to finish

✅ Guaranteed results or your money back

Frequently Asked Questions:

How long does it take to get an ITIN?

- Usually between 6 to 12 weeks, sometimes faster with an authorized agent.

Do I have to send my original passport?

- No, we use secure methods through authorized agents without the need to send the original passport.

Is the number permanent?

- Yes, an ITIN is only issued once and stays with you forever.

Is the service legal?

- Yes, it is 100% legal and complies with IRS regulations.

Don't miss the opportunity!

An ITIN is your key to accessing the US financial system, expanding your online business, and receiving payments professionally.

Contact us now and get a free consultation about your case, and let our team take care of all the details.

With our experience, we've transformed the complex steps into a simple and convenient experience for you. Don't hesitate, get started today!

Start your international financial journey today… and let us help you open the doors.